Are you a First Abu Dhabi Bank (FAB) account holder looking for a hassle-free way to check your account balance? This comprehensive guide will walk you through various methods FAB bank balance check online conveniently. Whether you prefer using the online banking portal, mobile app, SMS, or other options, we’ve got you covered.

Fab Balance Check: 5 Easy Methods

Method 1: Using the FAB Bank Website

Simple Steps of FAB Balance check

Step 1: Visit the FAB website. Once there, you’ll find two empty boxes awaiting your information.

Step 2: In the first box, enter the last two digits of your FAB card.

Step 3: Now, fill the second box with the 16-digit Card ID number on the front bott om of your FAB card.

Step 4: With all the details entered, click the ‘Go’ button.

Step 5: You’ll be swiftly redirected to your account page, where you can instantly view the total balance of your FAB bank account in real time. FAB Balance check has always been more complex!

Method 2: Using the FAB Bank Mobile App

Quick and Easy Way to Check FAB Bank Balance on the Go

Step 1: Download the FAB Bank mobile app from Play Store or App store.

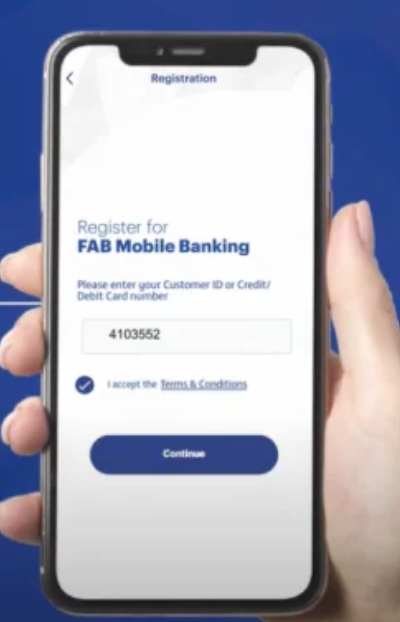

Step 2: Open the app and log in with your credentials. If it’s your first time, enter your customer ID or debit card number, split the password to your registered mobile number or email, and generate a 6-digit PIN for future logins.

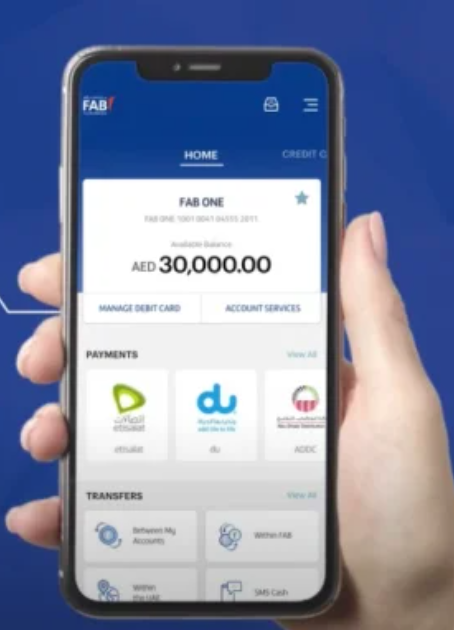

Step 3: Once logged in, your account balance is on the homepage for instant access.

Step 4: Explore your past transactions and other details conveniently within the app. Stay on top of your finances effortlessly!

Method 3: Using FAB Bank ATM

Step 1: Visit any nearest FAB bank ATM

Step 2: Select Check Balance from the menu

Step 3: now enter your ATM PIN, and your balance will be displayed on the screen

Method 4: Checking FAB Bank Balance via SMS

FAB also provides a convenient method of FAB balance check with a single SMS.

Just send a text message with “BAL” type the last 4 digits of your account number, and send it to 2121.

Method 5: Checking FAB Bank Balance via Customer Support Call

When internet connectivity is an issue, or you find yourself distant from an ATM, FAB ensures you can effortlessly check your balance with a phone call.

To inquire about your bank deposit balance, dial FAB’s 24/7 customer service line at 600 52 5500.

FAB Salary Account Balance Check

At FAB Bank, managing your salary becomes a breeze with a designated salary account. This specialized account streamlines your access to your hard-earned money, ensuring a seamless experience overseeing your salary and other financial transactions. Additionally, the FAB bank salary account balance check process aligns with the general procedure applicable to all FAB bank accounts.

Use any previously mentioned methods to check your fab salary account balance.

How To Open a FAB Bank Account: Step-by-Step Guide

Opening a First Abu Dhabi Bank (FAB) account is straightforward. Follow these simple steps to embark on your journey with FAB:

Step 1: Gather Required Documents

Collect the necessary documents, including a valid Emirates ID, passport, visa (for non-residents), and proof of address (utility bill, tenancy agreement, etc.).

Step 2: Choose the Account Type

Determine the type of account you want to open, whether a savings account, a current account, or a specialized account that suits your financial needs.

Step 3: Visit the Nearest FAB Branch

Locate the nearest FAB branch or visit an authorized FAB representative. Make sure to bring all the required documents with you.

Step 4: Speak to a Customer Service Representative

Once at the branch, approach a customer service representative and express your intention to open an account. They will guide you through the process.

Step 5: Complete the Application Form

Fill out the account application form with accurate and up-to-date information. This form is crucial for creating your FAB account.

Step 6: Provide Necessary Information

Hand over the required documents and any additional information the bank requested.

Step 7: Agree to Terms and Conditions

Review and agree to the terms and conditions provided by FAB. Ensure you understand the account features, fees, and other relevant details.

Step 8: Receive Your Account Details

You will receive your new FAB account details upon completion, including the account number and relevant information.

Step 9: Activate Your Account

Follow any additional bank instructions to activate your account, such as setting up online banking or obtaining a debit card.

Congratulations! You’ve successfully opened an FAB bank account. Now, enjoy the convenience of managing your finances with one of the leading banks in the region.

How To Activate FAB Mobile Banking

Embark on the journey of seamless banking by activating FAB mobile banking. Follow these steps to ensure a smooth setup:

Step 1: Download the FAB Bank Mobile App

Visit your device’s app store, whether the App Store for iOS or the Play Store for Android. Please search for the FAB Bank mobile app and download it to your device.

Step 2: Install and Open the App

Once the download is complete, install the app and open it on your device.

Step 3: Enter Your Debit Card Details and OTP

You’ll be prompted to provide your debit card details for security purposes. An OTP (One-Time Password) will also be sent to your registered mobile phone or email address. Enter these details to proceed.

Step 4: Create a New Login Password

Follow the on-screen instructions to create a new login password. Ensure that your password is strong and secure. This will be your key to accessing FAB mobile banking.

Step 5: Verify Your Identity

To enhance security, FAB may require additional verification steps. Be prepared to confirm your identity through a secure process.

Step 6: Set Up Security Measures

Explore the app’s security features, such as enabling biometric authentication (fingerprint or face recognition) if available. This adds an extra layer of protection to your mobile banking account.

Step 7: Explore App Features

Familiarize yourself with the various features the FAB mobile app offers. This may include Fab balance check, reviewing transactions, transferring funds, etc.

Step 8: Register Additional Services (Optional)

If FAB offers additional services within the mobile app, such as bill payments or card management, take the opportunity to register for these services if needed.

Congratulations! You’ve successfully activated FAB mobile banking. Enjoy the convenience of managing your finances with this user-friendly and secure mobile banking app.

FAB Bank Minimum Balance

Discover the specifics of maintaining a minimum balance with FAB Bank:

No Minimum Balance for General Accounts:

There is generally no minimum balance requirement for a standard FAB Bank account.

Minimum Balance for Personal Saving Accounts:

A minimum balance of 3000 AED is required if you have a personal savings account.

Penalty for Falling Below Minimum:

Dropping below the 3000 AED minimum may incur a penalty of 10 AED per month.

Exception for Elite Saving Account Holders:

The default Elite saving account doesn’t mandate a minimum balance for those using their FAB account, primarily for deposits and withdrawals.

Stay informed to make the most of your FAB banking experience.

What Is FAB Swift Code?

Regarding international finance, the FAB Swift Code ensures the smooth flow of funds across borders. This unique identification code distinguishes First Abu Dhabi Bank globally and facilitates secure transactions.

The SWIFT Code for FAB Bank is NBADAEAAXXX. SWIFT, an acronym for the Society For Worldwide Interbank Financial Telecommunication, operates as a global organization offering secure and dependable financial transaction services.

A SWIFT code serves as a unique identifier for a bank branch, facilitating the smooth transfer of funds within a domestic setting or across international borders.

For every financial transaction, whether sending or receiving money, it’s imperative to furnish the specific SWIFT code of the involved bank branch. This code ensures accuracy and security in the money transfer process.

FAQs

1. How do you get FAB bank statements online?

Log in to FAB online banking and download your statement.

2. How do you change the mobile number in FAB bank?

Visit a branch or contact customer service to update your mobile number.

3. Can I close my FAB bank account from abroad?

Yes, contact FAB customer service for guidance on closing your account from abroad.

4. Can I make a SerGas payment through FAB Bank?

You can pay SerGas bills through FAB bank via online banking, ATM, or customer service.

5. How can I change my address in FAB Bank?

Visit a nearby FAB branch with proof of your new address to update it.

6. How do I change my FAB bank trade license?

Visit the FAB branch where you hold the business account to update the trade license.

7. How long does it take to make a bank account in FAB?

Opening a bank account in FAB varies but typically takes a few business days.

8. How do you apply for a loan from FAB Bank?

Apply for a loan in FAB by visiting a branch or applying online, providing the necessary documentation for review.